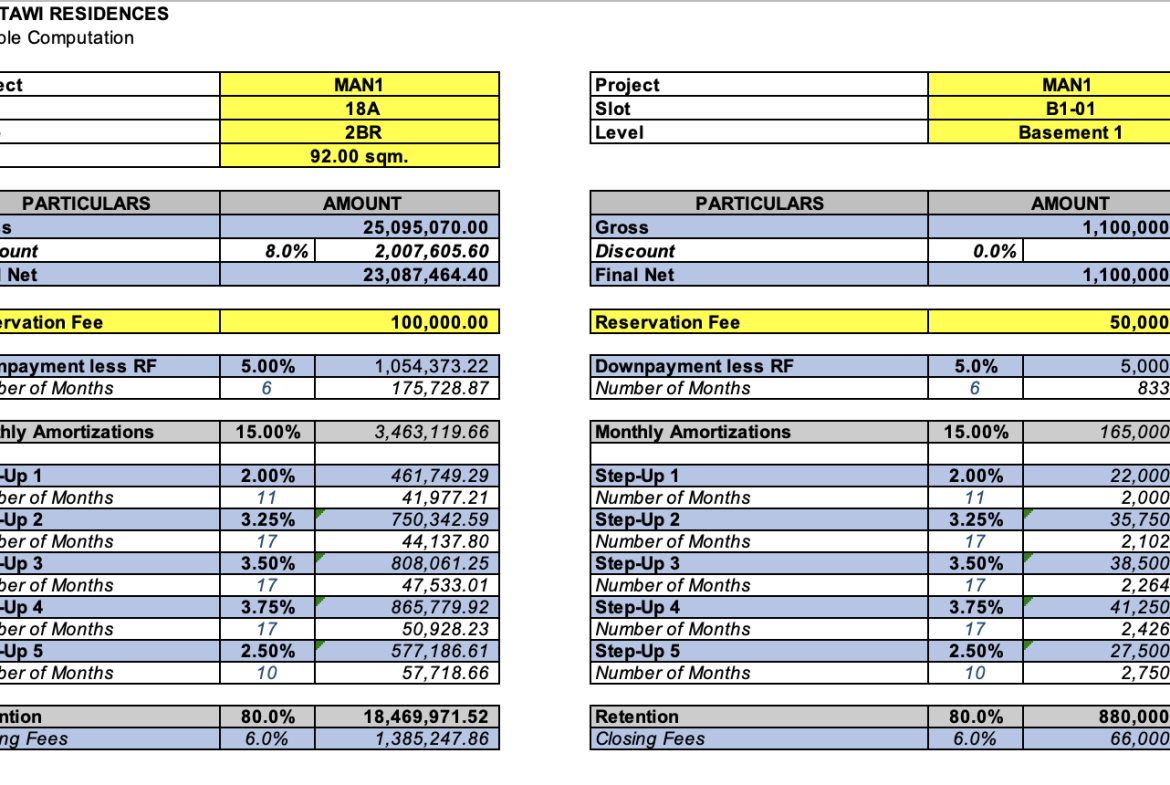

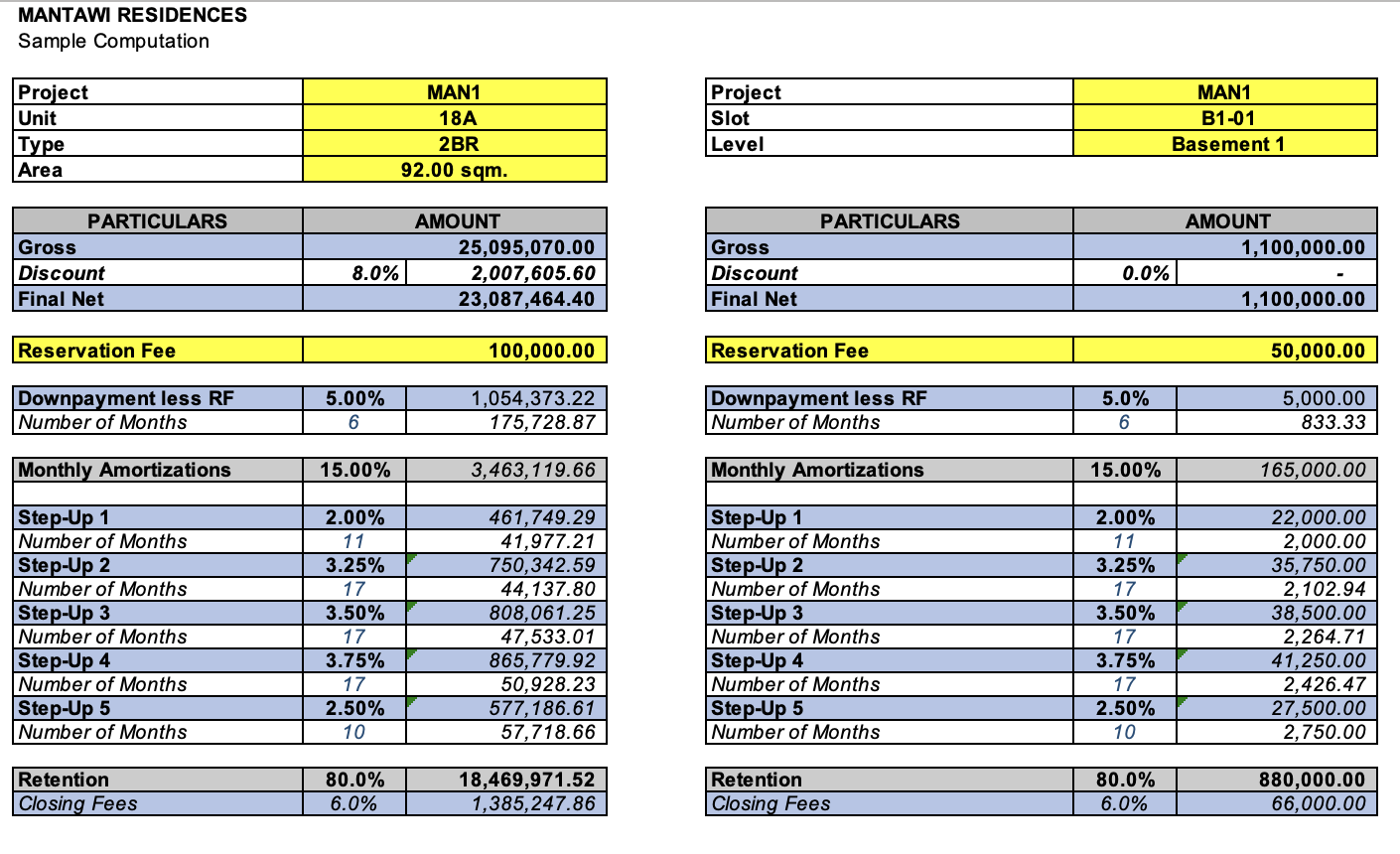

Mantawi Residences Unit 18A 2Br 92sqm 8% Discount by Robinsons Land Corporation

Overview

- Condo

- 2

- 2

- 92 Sq m

Description

📍 Location

-

Situated along Ouano Avenue (corner F.E. Zuellig Avenue), Mandaue City, Cebu.

-

The site is in a strategic area linking Mandaue city proper and metropolitan Cebu.

-

Nearby landmarks include:

-

Chong Hua Hospital ~1.5 km away

-

Cebu Business Park ~3.5 km away

-

Good connectivity (roads, infrastructure projects) expected in this area.

-

🏗 Project Overview

-

It is a four-tower, high-rise residential condominium development.

-

Each tower: ~40 floors with 14 units per floor.

-

Land area: Approximately 20,328 sqm (about 2 ha) for the overall site.

-

The amenity / open space area is large: about 1.3 hectares devoted to amenities.

-

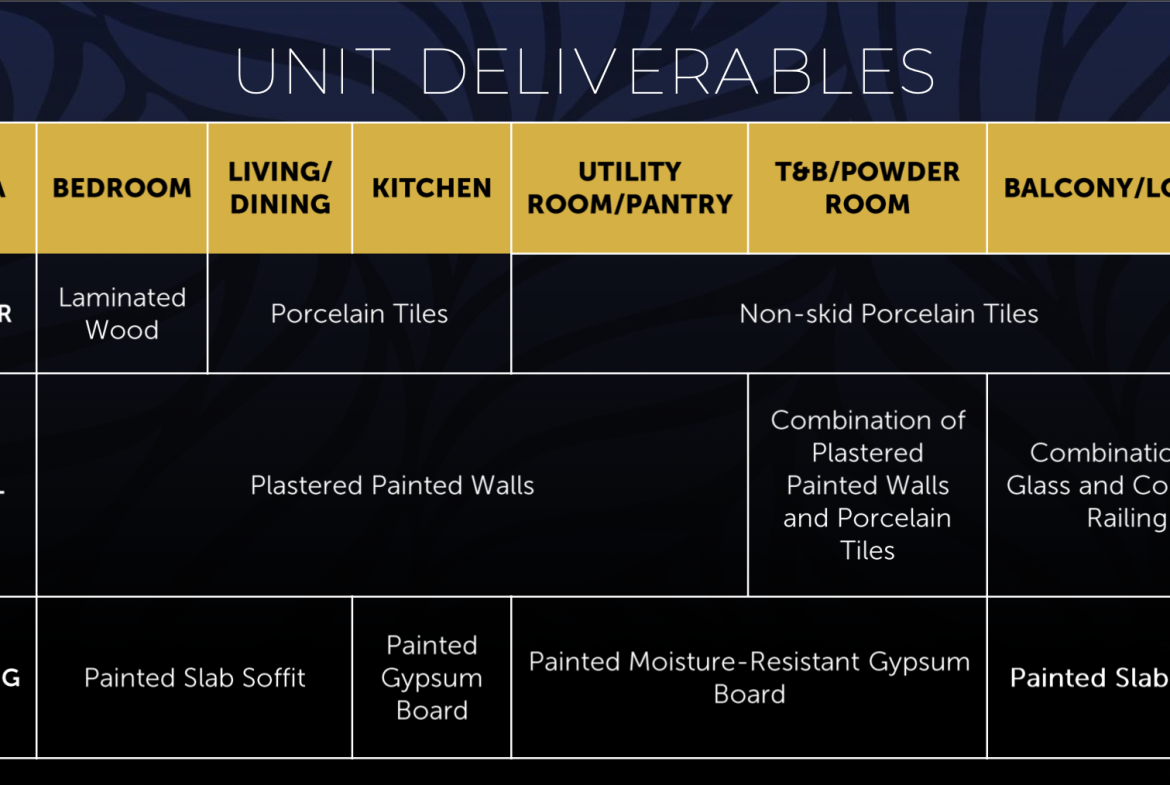

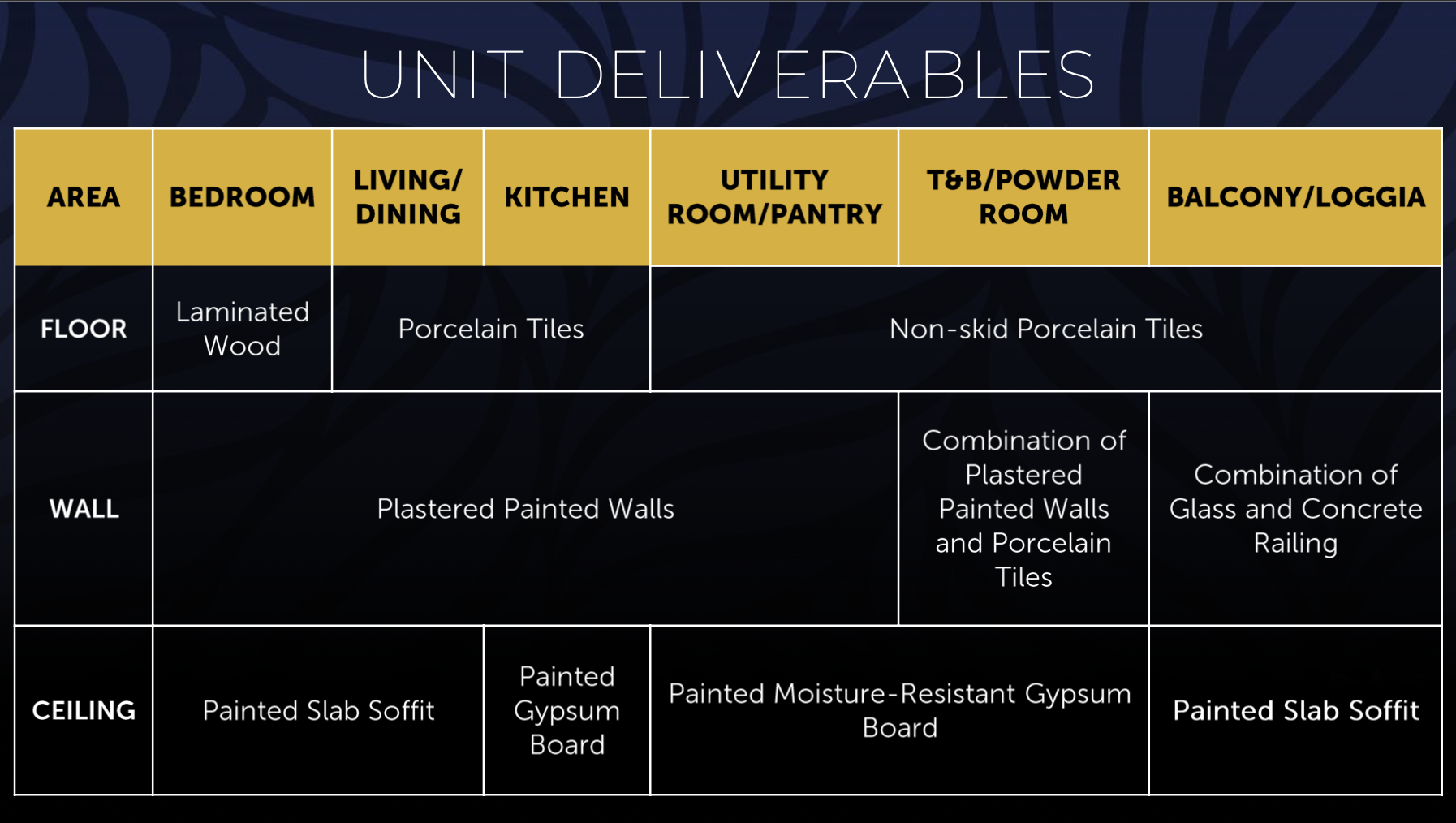

Smart-home ready units with upgraded deliverables (e.g., smart devices) are featured.

-

Sustainability credentials: the project earned the preliminary EDGE certification (from the International Finance Corporation) — making it the first condo in Cebu with that distinction, reflecting focus on resource-efficiency.

🏠 Unit Types & Pricing (Indicative)

-

Layouts:

-

1-bedroom units: around 46 sqm

-

.2-bedrooms: ~92 sqm and ~115 sqm.

-

3-bedrooms: ~138 sqm.

- Penthouses: ~207 sqm

-

-

Pre-selling status (as of latest) — still pre-selling.

🎯 Amenities & Features

-

Outdoor amenities: kids’ pool, adult pool, pool decks, pet park, kids’ play area, jogging trail, al-fresco dining & grilling stations, landscaped areas.

-

Indoor amenities: residential lounge, work lounge, business centre, game room, private theatre, fitness centre, function rooms, spa, etc.

-

Security & building features: key-card access, CCTV in common areas, fire safety systems.

-

Retail / commercial elements: Ground-floor retail is planned, bringing convenience and lifestyle value.

✅ Why It Might Be Attractive

-

Prime location: Very accessible, near major hubs in Cebu, which is good for both living and investment.

-

Large amenity area: Having ~1.3 ha for amenities gives a high-end lifestyle feel.

-

Premium positioning: It’s considered a “premium” offering by the developer in this region.

-

Sustainability: EDGE certification and smart-home features elevate its value proposition.

-

Developer track-record: RLC is a known player in Philippine real estate.

⚠️ Things to Consider / Questions to Ask

-

Delivery timeline: Since it’s pre-selling, check exact expected turnover date and possible delays. For example, some sources mention turnover first quarter of 2029 for Tower 1.

-

Total cost of ownership: Consider monthly association dues, parking fees, maintenance etc.

-

Unit orientation & floor level: Views, noise, ventilation will vary significantly by floor/unit type.

-

Resale & rental prospects: Given premium pricing, check comparable resale/rental rates in the area to assess investment viability.

-

Infrastructure/area developments: While location is promising, new infrastructure projects may bring both benefit (appreciation) and inconvenience (construction noise/traffic) in the interim.

Address

Open on Google Maps- Address Ouano Avenue, corner of F.E. Zuellig Avenue, Brgy. Subangdaku, Mandaue City, Cebu Province, Philippines.

- City Mandaue City

- State/county Cebu Province

- Zip/Postal Code 6014 (postal code for Mandaue City)

- Area Subangdaku (near Ouano Avenue / F.E. Zuellig Avenue)

- Country Philippines

Details

Updated on January 3, 2026 at 3:23 am- Price: ₱25,095,070

- Property Size: 92 Sq m m²

- Land Area: 20328 Sq m m²

- Bedrooms: 2

- Bathrooms: 2

- Property Type: Condo

- Property Status: For Sale

- Rent / Buy: Buy

Features

Mortgage Calculator

- Down Payment

- Loan Amount

- Monthly Mortgage Payment